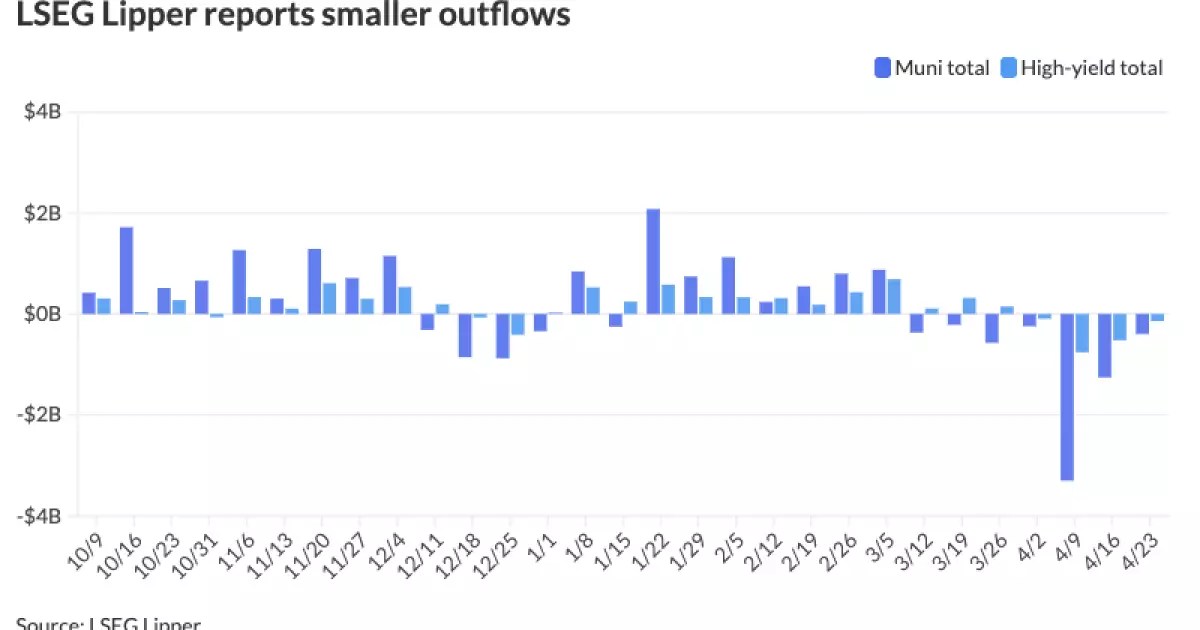

Municipal bonds have traditionally been seen as a safe haven for conservative investors, offering both a modest return and tax-exempt yields. Yet, the recent fluctuations in this market highlight a concerning trend that should alarm those with investments riding on the stability of municipal debt. The consistent outflows from municipal bond mutual funds—amounting to a staggering $397.4 million in just one recent week—have raised red flags, suggesting a lack of confidence that may not only affect the short-term outlook but also the long-term viability of this asset class.

The most recent reports indicate a continued decrease in demand for municipal bonds, contradicting the traditional belief in their safety and stability. With investor sentiment turning pessimistic, the market dynamics are playing out much like a house of cards, fragile and susceptible to major shifts. If this trend continues, it won’t just hurt municipal bond prices; it could undermine public projects and emergency funding at the state and local levels, where municipalities are often the last bastion of stability in an ever-evolving economic landscape.

Rising Yield Rates and Diminishing Demand

In a perplexing twist, municipal bond yields have shown an increase—up to seven basis points in certain cases—while the yields on U.S. Treasuries have fallen between six to ten basis points. Typically, one might expect that when Treasury yields decline, municipal yields follow suit to keep the attractive tax-exempt advantage intact. However, the current environment showcases a disconnect between supply and demand, leading to heightened yield profiles that could dissuade prospective investors.

The ratio of two-year and five-year municipal bonds sits precariously at 79%, while the ten-year and thirty-year options yield slightly better at 80% and 94% respectively. While these numbers might seem appealing on the surface, they mask a grim reality underneath. The demand for these bonds is fading amid unease over economic policy and trade—exacerbated by erratic tariff negotiations—causing market participants to tread lightly. For those of us on the center-right, the implications of these dynamics pose a serious threat to fiscal responsibility and the underlying economic health of our communities.

Market Anxiety and Supply Chain Pressures

Market analysts and strategists like Kim Olsan from NewSquare Capital have candidly noted that investor sentiment can shift rapidly, often influenced by external economic factors—least of which include the ongoing trade negotiations with China. The recent announcement of a 90-day pause on tariffs may have provided a temporary reprieve, fostering some optimism in the municipal market. However, as BlackRock strategists aptly pointed out, supply-and-demand dynamics remain a formidable headwind.

The current state resembles an economic chess game where two opposing forces—uncertainty and evolving tax laws—sit in a stalemate. While the municipal bond market appears to be recovering slightly, albeit from a low starting point of negative returns, the systemic issues of diminished liquidity remain unaddressed. Investors are understandably discouraged as they face heightened uncertainty, stripping away the allure of municipal bonds that once offered reliable cash flow.

New Issues and Demand Recovery: A Distant Possibility?

Despite the turbulent climate, some hope lies in the resurgence of new issues. There have been recent developments, like the pricing of significant general obligation bonds in states such as Massachusetts and Connecticut, where yields did experience modest cuts. While this suggests that some issuers might be able to weather the storm, it is important to probe the sustainability of this recovery.

The question arises—will new issuances lead to a genuine revival of interest in the municipal market, or are they merely a temporary buoy in an otherwise turbulent sea? As issuers look to front-run potential tax law changes, investors must approach this situation cautiously. The very notion that taxpayers will bear the brunt of unfulfilled obligations casts a dark shadow over any potential recovery, raising concerns about fiscal prudence and accountability.

The Bigger Picture: Implications on Public Projects

It’s crucial to recognize that the ramifications of declining municipal bond stability extend far beyond mere financial returns. Public projects—from essential infrastructure to educational funding—often rely heavily on the robustness of municipal debt. When investors begin to lose faith in a stable return from bonds, municipalities may struggle to secure the necessary funding for these vital public works.

For a center-right liberal like myself, this situation is particularly concerning. We recognize the value of efficient governance, fiscal responsibility, and maintaining public confidence in our financial systems. If municipalities can’t attract sufficient investors to support their bond issues, the ripple effect could hinder public serves at an unprecedented scale. It bears emphasizing—a thriving bond market is not just a personal investment concern; it’s a cornerstone of community development and public welfare.

The municipal bond market currently faces a confluence of challenges that call into question its traditional role as a safe investment avenue. Investors must remain vigilant as they navigate this unpredictable landscape, not just for themselves but for the broader implications that touch upon fundamental societal infrastructure.

Leave a Reply