Municipal bonds, once a reliable investment vehicle for risk-averse investors, now find themselves in a precarious position amidst shifting interest rates and government fiscal strategies. Recent reports indicate a slight firming in certain segments of the municipal bond market, coinciding with a decline in U.S. Treasury yields. However, this perceived stability is deceiving. While the month-to-date performance shows munis garnering modest gains, a deeper analysis reveals underlying issues that could derail future momentum.

Investor confidence is faltering. Despite a reported 0.45% uptick in munis so far this month compared to a 0.89% increase in U.S. Treasuries, many professionals are expressing concern over the broader dynamics at play. JB Golden, a seasoned market analyst, points out that municipals are still lagging by significant margins—over 340 basis points—compared to Treasuries and almost 360 basis points against investment-grade corporates on a year-to-date basis. This stark underperformance raises questions about the sustainability of current trends and whether municipal bonds have truly shaken off the shackles of past declines.

Political Clouds Affecting Clarity

One of the most alarming aspects of the municipal bond landscape is the palpable political uncertainty that pervades the market. Government policies at both state and federal levels seem to fluctuate unpredictably, creating a climate of fear that discourages investment. Golden has alluded to how recent clarity on the political front has aided the market’s digestion of excessive supply, but is it enough?

The looming threat of reduced federal support for state and local governments could exacerbate the challenges municipal bonds face. This eventual reduction could further enhance the supply of new debt, a concern echoed by various analysts. Higher issuance, while initially stimulating, can also flood the market with options that lead to diminishing returns for investors. Ultimately, this can dampen enthusiasm, especially among conservative buyers who prefer a cautious rather than a speculative approach.

Record Supply: A Double-Edged Sword

The municipal bond market has experienced a remarkable surge in issuance—up 16% year-over-year. This number, while seemingly promising, is largely driven by necessity rather than opportunity. The first-quarter supply reached a staggering $119.2 billion, and the market has been this congested supply-wise, leading to the risk of oversaturation. Investors may be tempted to view this trend positively, especially when faced with larger reinvestment periods anticipated over the summer.

However, the statistics paint a different picture when dissected further. In May alone, as municipalities issued $50 billion in new debt, competition for investor dollars became fierce. Following that, there was another $20 billion in just the first week of June, signaling a frenetic pace that could lead to burnout. In a climate where interest rates are not consistently dipping, such heightened activity makes one wonder if municipalities are acting out of prudent financial strategy or simple desperation.

Valuation Woes and Market Dynamics

Increased supply may have pushed valuations to enticing levels, but the question remains: how aligned are these valuations with investor demand? More concerning is the notion that while valuations may be attractive, the tailwind effect Golden refers to could be fleeting. If interest rate volatility continues on its current trajectory, the adjustments in valuations may not resonate with the broader investing populace.

The undercurrents affecting municipalities, such as a potential economic slowdown driven by political decisions and societal unrest, could lead to a sharp reversal. The market’s precarious balancing act could easily transform into a downward spiral if sentiment shifts or government interventions fail to bolster the financial ecosystem.

Investment Trends: The Changing Face of Demand

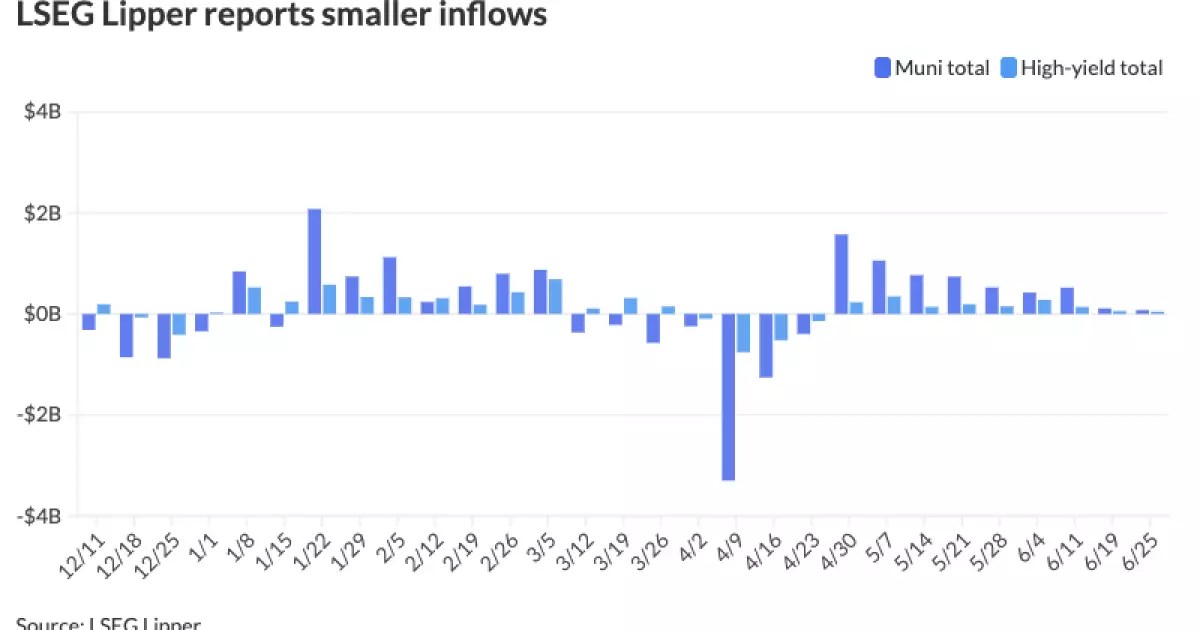

Investor behavior also adds another layer of complexity. Recent data shows a modest flow of $76.9 million into municipal bond mutual funds, indicating cautious optimism. However, this is contrasted against a backdrop of larger inflows in taxable funds, suggesting that risk appetites may be shifting away from traditionally safer muni holdings. As high-yield funds see comparative inflows decrease, one must ask—are investors seeking greener pastures?

Moreover, the anomaly where tax-exempt municipal money market funds witnessed inflows of $1.901 billion casts a shadow over the overall confidence in municipal bonds. With taxable money market assets accumulating $9.87 billion, this growing preference for taxable mechanisms could signal dwindling faith in the muni segment, historically seen as the bastion of long-term investment.

The complexities of the municipal bond landscape cannot be understated. With many investors remaining understandably cautious, the forces of volatility and political uncertainty loom large. While the current slight uptick may appear comforting at first glance, the reality is that the road ahead is perilously uncertain, and a keen eye must be kept on these evolving dynamics.

Leave a Reply