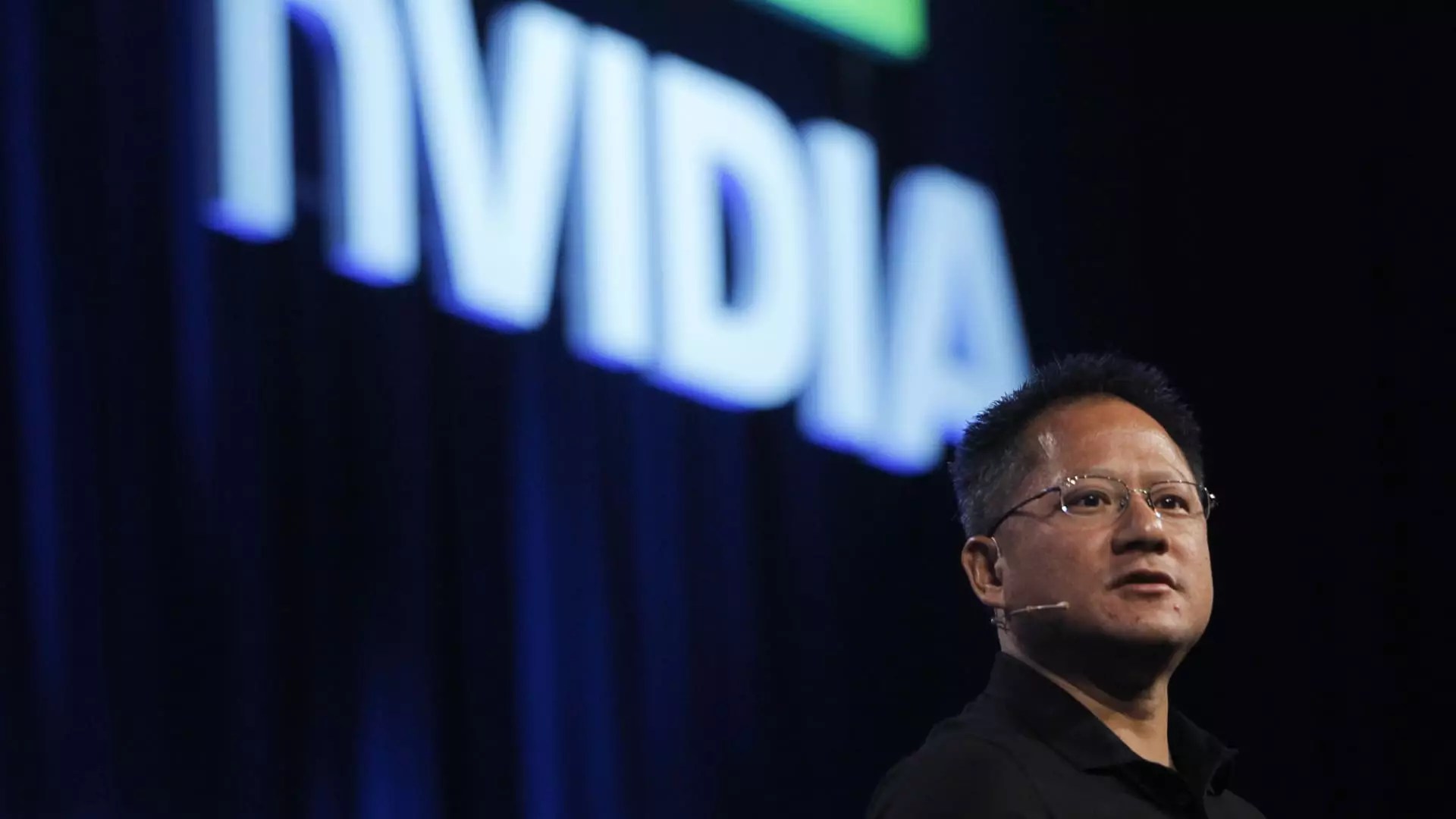

In the realm of technology investment, few names resonate as powerfully as Nvidia. The company’s robust performance is no coincidence; it’s a result of a strategic focus on artificial intelligence and graphics processing. As demand for AI applications soars, Nvidia stands poised at the forefront, anticipating a massive influx of new projects and partnerships that could significantly enhance its market presence.

Analysts foresee a solid upward trajectory for Nvidia, projecting its price target to rise substantially. The logical reasoning behind this optimism lies in the company’s unparalleled capability in AI scaling, its adept handling of complex computing tasks, and the depth of its developer ecosystem. As industries increasingly pivot towards automation and machine learning, Nvidia’s hardware is not just a component but an essential pillar for progress. This is not just a speculative projection; it’s a transformative trend that is already reshaping entire sectors. For investors, acknowledging Nvidia’s potential is not just prudent but necessary.

Streaming to New Heights: Netflix’s Unparalleled Growth

Netflix is far from a passing trend; it’s a revolutionary player in the entertainment landscape. This streaming giant is riding the wave of shifting consumer habits, positioning itself as a leader not only in original content but also in advertising technology. Analysts have recently expressed renewed confidence in the stock, raising its price target significantly as Netflix solidifies its market dominance.

What makes Netflix particularly compelling is its ability to continuously innovate and adapt. Unlike many competitors who struggle to achieve profitability, Netflix has cultivated a formula for sustained earnings growth and significant cash flow generation. The introduction of advanced advertising strategies signifies not just growth potential but also a diversification of revenue streams that could redefine its business model. Investors should capitalize on this momentum; the foresight to recognize Netflix’s unmatched scale and growth potential could translate into substantial long-term gains.

Boot Barn: Riding the Wave of Lifestyle Investments

In a marketplace increasingly dominated by fast-fashion and fleeting trends, Boot Barn stands out as a beacon of resilience and growth. This Western-themed footwear and apparel trading company continues to thrive, showcasing impressive year-over-year performance. Analysts have recently raised their price target, reflecting a slew of friendly factors that fortify Boot Barn’s growth trajectory.

What sets Boot Barn apart is its ability to resonate with a specific lifestyle demographic, allowing it to build a strong community around its branding. As the company expands its offerings and enhances its customer service, it’s not merely competing on price; it’s carving out a niche that encourages loyalty and repeated business. The favorable pricing environment also suggests that Boot Barn has the potential to snatch up market share from competitors. Investors should consider this branding strategy as a vital part of their portfolios—investing in companies that can create a compelling narrative is essential in a competitive market.

The E-commerce Battle: Amazon’s Innovations

Amazon continues to dominate not just the retail sector but also the technological landscape. The latest projections suggest that innovations in robotics and drone technology can significantly enhance operational efficiency. Analysts have raised the price target for Amazon stock, underscoring its deep-seated competitive advantages in a fast-evolving e-commerce ecosystem.

These technological advancements are poised to alleviate labor costs, boost delivery speed, and improve overall operational accuracy, allowing Amazon to remain a step ahead of its competitors. As e-commerce continues to expand globally, Amazon is not merely riding the wave but actively shaping it. The investment community should take heed of this company’s groundbreaking strides in operational efficiencies that promise robust returns.

Philip Morris: A Surprising Turnaround Story

While traditionally associated with tobacco, Philip Morris is pivoting towards a contemporary narrative centered on smoke-free products. Contrary to the outdated perception that the company merely represents traditional tobacco products, its strategic investment in alternative products has garnered attention from forward-looking investors. As the global market integrates stricter regulations around smoking, Philip Morris is increasingly regarded as a pioneering force in the development of reduced-risk products.

The focus on innovative harm-reduction products signals a paradigm shift that investors can capitalize on. Philip Morris is not just managing a reputation; it’s undergoing a renaissance that illustrates proactive adaptation to market demands. This makes it an intriguing investment opportunity for those considering companies poised to benefit from cultural shifts towards healthier lifestyles, further diversifying an investment portfolio.

Navigating the complexities of financial investment requires a keen eye on growth potential, and these stocks—Nvidia, Netflix, Boot Barn, Amazon, and Philip Morris—represent diverse avenues for profiting in today’s fast-paced market. Ignoring the trajectory of these companies means missing out on opportunities that could define the investment landscape for years to come.

Leave a Reply