The municipal bond market is often regarded as a stable, secure investment, typically appealing to risk-averse investors such as individuals and institutions seeking safe harbor amidst market volatility. However, recent dynamics suggest that stakeholders might need to reflect deeply on the underlying issues concerning the state of municipal bonds. Tuesday’s steady performance amid rising U.S. Treasury yields presents a perplexing picture: is stability a facade in a precarious environment? When the equities market saw a downturn, bond investors appeared shielded, but external influences and alarming trends raise critical concerns about the resilience of this investment class.

The current two-year municipal-UST ratio stands at a mere 70%, signaling a potential misalignment between munis and Treasuries. As market volatility increases, the reliance on traditional metrics becomes questionable. A ratio of this nature hints at broader complications, particularly for municipal bonds that are perceived, often incorrectly, as insulated from economic upheaval. Recent events following tariff announcements demonstrate that even munis are not immune to risk-off sentiments, highlighting an unsettling reality where investors are increasingly wary of traditional safe havens.

Inflationary Pressures and Municipal Demand

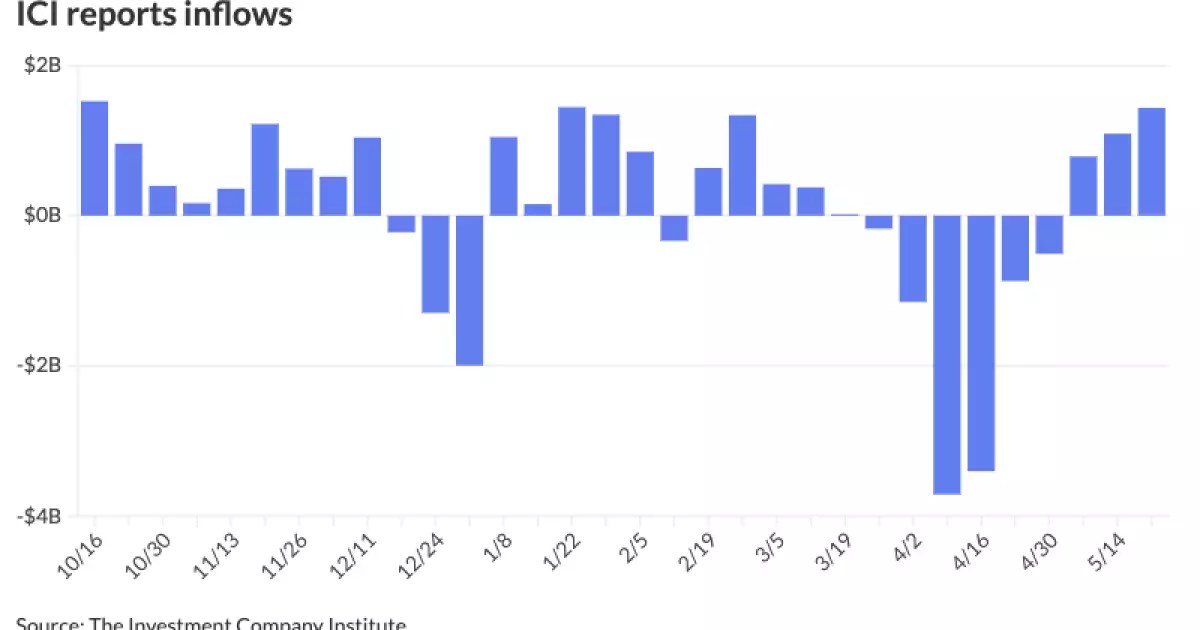

Another disturbing trend in the municipal bond space is its current dependency on retail investors through separately managed accounts (SMAs) and exchange-traded funds (ETFs). While these segments may seem strong, they are fundamentally fragile. According to reports, demand remains unduly reliant on retail channels, which historically perform at their best in bullish market environments. Recent inflows, with $1.435 billion recorded just last week, may reflect a temporary uptick rather than sustained demand — a point made clear by Jeremy Holtz. Are investors placing undue faith in these waters that could easily become turbulent?

Furthermore, with the looming federal aid cutbacks for various blue states and cities, municipalities are expected to face escalating economic pressures. Tariffs and potential deportations contribute to an already fragile economic landscape. As tax reforms threaten to push costs down to state levels, the sustainability of municipal financing comes into question. Investors need to grapple with this contractual uncertainty before engaging in what may appear to be enticing opportunities.

Summer Blues: A Period of Uncertainty

Traditionally, summer months bring a drop in issuance, allowing for a smoother operational environment as municipalities take a breather. However, the situation this year is augmented by a record pace of issuance. In fact, we have seen issuance rates soar to $213 billion year-to-date, up significantly from last year. The paradox is glaring: heightened issuance combined with a lack of scaled-up institutional demand could create a perfect storm of liquidity issues. Is this the time for investors to reconsider their positions with so many variables at play?

Matt Fabian points out that summer months are typically positive for municipals due to reinvestment opportunities. However, the reality could be far more complex this year. A notable influx of issue supply could stifle the market, suggesting that typical seasonal patterns may not hold firm. The bond market appears to be walking a tightrope, caught between reassuring records and unforeseen turbulence that could emerge at any moment.

The Influence of Economic Factors

The reality is that broader economic conditions are daunting, bringing new questions to light about the viability of municipal bonds as the go-to refuge from market volatility. With the Federal Emergency Management Agency (FEMA) facing challenges akin to those experienced last hurricane season, the implications of an unprepared federal response during crises only heighten risks for municipalities.

While we can celebrate the apparent technical strengths of the municipal market, we should not ignore the detrimental effects that tariffs may have on local economies. Such pressures could result in local governments struggling to meet financial commitments, thereby adversely affecting bond yields. What does that say about the long-term outlook for an asset class perceived as risk-averse?

Investor Realities and the Future of Municipal Bonds

As the municipal bond landscape navigates these perplexing realities, it becomes increasingly important for investors to maintain acute awareness of their positions. The market is shifting, and traditional metrics may not paint a full picture. The wide swings in yield, absence of institutional stability, and increasing reliance on retail interest all point to a precarious environment.

Investors should be wary of unfamiliar strains entering the bond market as political dynamics and economic pressures converge. Moreover, the long-standing perception of municipal bonds as secure options must evolve in light of these alarming trends. A prudent approach might necessitate a reassessment of investment strategies going forward, as the classic narrative of safety may no longer hold true in turbulent waters. Investors would do well to evaluate their holdings critically, keeping an eye on potential shifts that could redefine the landscape of municipal investing in the near future.

Leave a Reply