As the municipal bond market grapples with a wave of volatility, investors are encountering mixed signals that threaten their cautious optimism. Recent trends indicate a deterioration in municipal bond yields, with cuts observed in excess of nine basis points. While U.S. Treasuries exhibit a mixed performance, the equities market has seen a notable sell-off. Charles Schwab’s fixed-income strategist, Cooper Howard, pointed out that this turbulence stems from protracted uncertainties that have surrounded the financial markets for months. The anxiety regarding federal policies, including tariffs, is palpable, creating an environment where investors are paralyzed by fear and indecision.

Those in charge of steering investments must now navigate a tempest of rising inflation, interest rate adjustments, and impending regulatory changes. Market sentiment appears overly sensitive; investors are fixating on singular risks, creating a domino effect that amplifies volatility. As James Pruskowski from 16Rock Asset Management notes, the market appears thinly liquid, and buyers have largely retreated. It’s a precarious situation typical of troubled economic climates, leaving many to question the resilience of municipal bonds.

Opportunities Amidst Adversity

Despite the negative outlook, Howard suggests that significant opportunities still exist within the municipal bond landscape—particularly for high-income investors residing in high-tax states. Tax-equivalent yields crossing the 7% threshold are incredibly alluring and provide a counter-narrative to the prevalent pessimism. Given that over 70% of issuers in the Bloomberg municipal index maintain AAA/Aaa or AA/Aa ratings, the allure of municipal debt remains robust for these investors.

It’s important to recognize, though, that the overall credit quality has likely plateaued. Nevertheless, Howard expresses confidence that resilience will persist in the near term. With yields projected to remain mostly stable relative to U.S. Treasuries—showing limited fluctuation unless there’s a substantial shift in market dynamics—investors may find new strategies in a seemingly waning landscape. As the yield curve shows slight variations across different maturities, astute investors who can read the fine print may find solace in the discrepancies across the board.

The Conundrum of Seasonal Trends

History tells an intriguing story about March—a month notorious for low returns and hindrance of municipal bonds. The average return for March since 1980 is dismally a mere 0.03%, making it the weakest month of the year for these bonds. Investors tend to pull back as high-net-worth individuals traditionally sell off holdings to meet tax bills, making March a particularly frosty landscape for municipal bonds. Howard’s observations reveal that this trend isn’t just an anomaly; it paints a broader picture of a cyclical pattern that warrants careful consideration when strategizing in this sector.

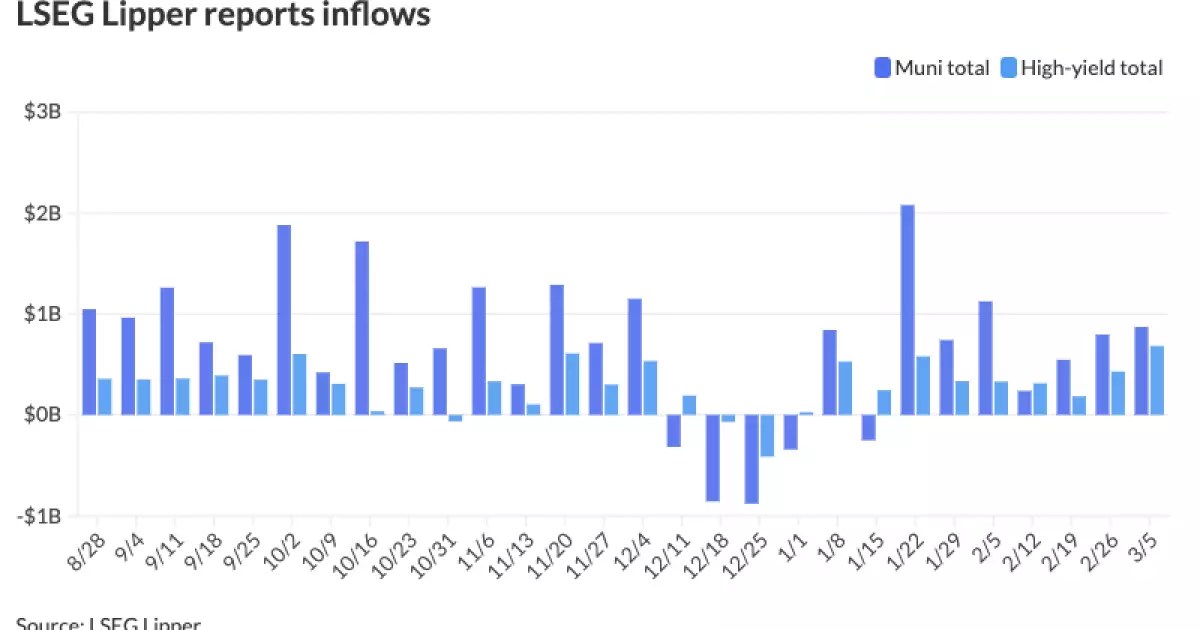

Moreover, amidst these challenges, there has been a distinct uptick in fund flows. Investors added over $872 million to municipal bond mutual funds recently, a promising sign that suggests some level of confidence is making its way back into the market. Nevertheless, given the multifaceted nature of present-day economic challenges, this increased inflow could be solely a temporary reaction to brief market fluctuations rather than an indication of a sustained rally.

The Significance of High-Yield Bonds

The arrival of innovative financial instruments like Macquarie Asset Management’s newly launched high-yield municipal bond ETF emphasizes the evolving landscape. The announcement showcases a commitment to depth and research-driven decision-making in pursuit of risk-controlled returns. Such developments present a clarion call to investors, urging them to embrace high-yield alternatives to enhance their portfolios amidst market headwinds.

Yet, optimism about high-yield municipal bonds should come with caution. While they can deliver enticing tax-advantaged income streams, the trade-off often lies in increased risk. Proper assessment of the creditworthiness of these issuers becomes vital, especially in a climate where weaker credits face mounting pressures. The shrewd investor must assess not just the promise of yield but also the underlying risks that could swiftly negate any potential gains.

Examining Market Psychology

Understanding the marketplace’s psychology is pivotal for gauging how municipal bonds might perform moving forward. With a flurry of policies emanating from Washington, uncertainty reigns. The hesitation among investors to act has been exacerbated by thin liquidity and volatility, forcing many to remain sidelined. This kind of behavior manifests a broader trend noted across various market sectors: fear stifling opportunity.

Current market conditions have created a paradox. While on the surface, investors should find comfort in the tax-exempt nature of municipal bonds, the underlying psychological barriers may prevent them from capitalizing on available opportunities. To emerge unscathed from this cycle, investors need not only sound financial tactics but a robust understanding of market emotions driving their peers’ actions.

Unraveling the intricacies of the municipal bond market reveals a complex tapestry woven with both risk and opportunity. As conditions ebb and flow, those willing to scrutinize market dynamics and adapt their strategies are likely to benefit from the underlying resilience that still exists.

Leave a Reply