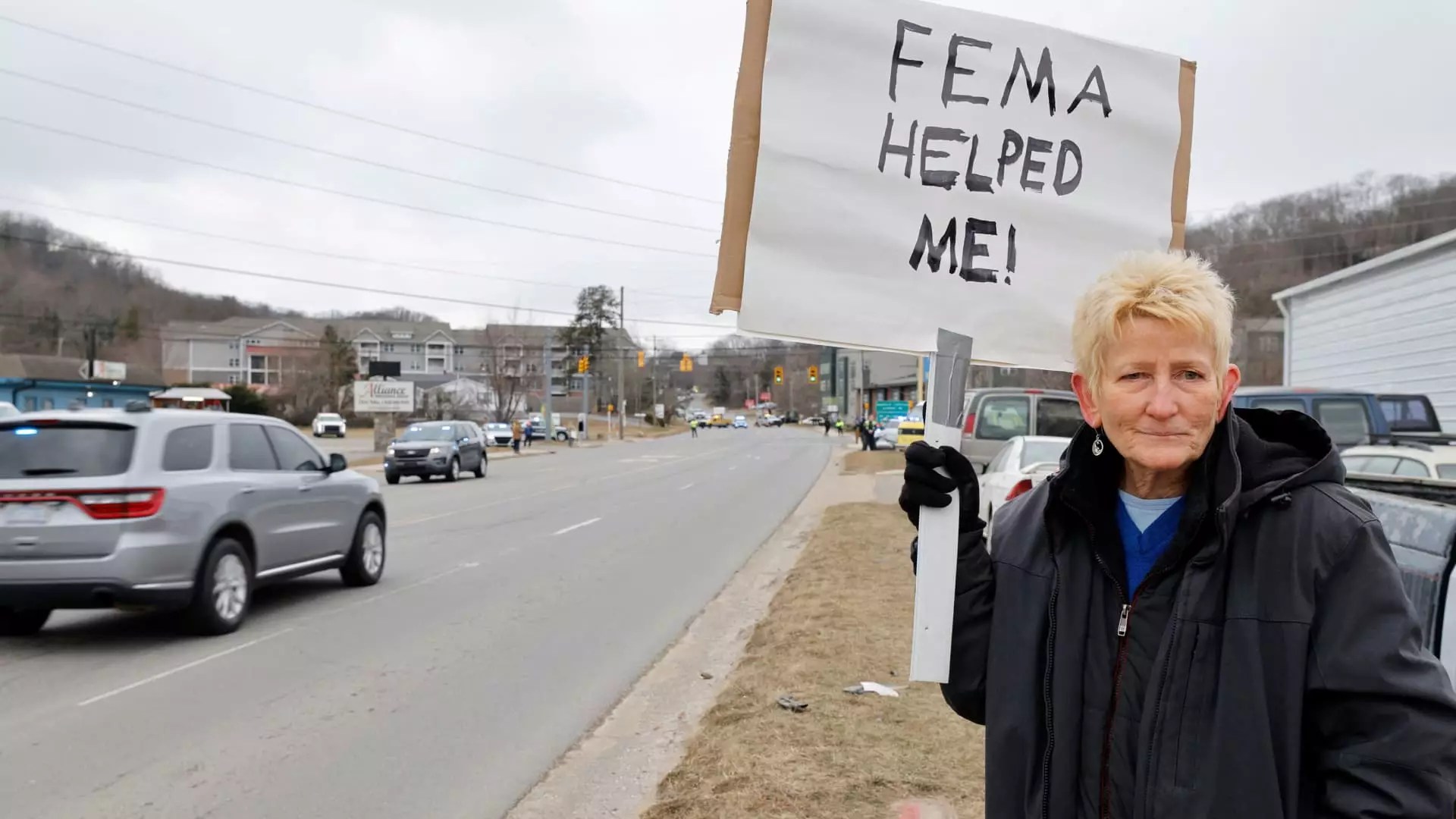

The recent announcements from the Trump administration regarding the future of the Federal Emergency Management Agency (FEMA) signal an unprecedented shift in how disaster management is prioritized in the United States. For years, FEMA has been a crucial lifeline during natural disasters, providing assistance that can often be the difference between recovery and ruin for affected homeowners and communities. However, as the administration considers phasing out FEMA as we currently know it, there’s a growing concern that this move may leave countless Americans vulnerable in the wake of catastrophic events.

President Trump’s remarks, particularly the intention to “start phasing [FEMA] out” after this year’s hurricane season, raise eyebrows and question the safety net that has protected so many. This is more than just bureaucratic reshuffling; it is a fundamental change in the safety and recovery structure that seems to favor a more individualistic approach to disaster preparedness—and this approach raises serious red flags.

The Misunderstanding of Insurance and Federal Aid

Insurance experts, like Charles Nyce, a professor of risk management and insurance, have made it clear that FEMA was never designed to replace private insurance. The agency serves as a supplementary support during federally declared disasters, offering financial assistance to those who have lost everything. Nyce’s insights highlight a critical misconception: FEMA’s role should not be understated as merely financial aid but as an integral part of a comprehensive disaster management strategy that also relies on homeowner insurance policies.

With the proposed cuts and reorganization, there is palpable concern that individuals will bear more responsibility without the proper support systems in place, leaving the most vulnerable citizens at greater risk. Trump’s assertion that the administration would “give out less money” signals a troubling trend toward privatizing disaster recovery, pushing individuals and local governments into a financial quagmire.

What the Proposed Cuts Mean for Citizens

According to sources, the proposed budget cuts to FEMA could reach as high as $646 million for the 2026 fiscal year. This presents a stark reality: local governments may soon be left to fend for themselves, with resources dwindling at the federal level. Experts warn that these cuts will shift the onus of recovery from FEMA to states and municipalities, effectively pulling the rug out from under a structured, federal disaster assistance program that aims to ensure a uniform recovery process across the nation.

Senator Raphael Warnock’s strong condemnation of these proposed changes emphasizes a growing fear that such reckless dismantling could lead to chaos in disaster response. With no solid alternative to the federal support system, communities are likely to struggle, disproportionately affecting lower-income households and regions that are less able to prepare for or recover from disasters.

Risks of Underprepared Homeowners

With the potential for reduced disaster aid, individuals are increasingly at risk of being underprepared when calamity strikes. Many homeowners may ignore the gaps in their insurance coverage, operating under the misconception that federal aid will step in when their policies fall short. The average individual assistance payout from FEMA hovers around $3,522—far from a sum that could genuinely cover extensive losses such as home repairs or displacement costs.

The administration’s comments about disaster loans and other forms of “assistance” further blur the lines regarding expectations for recovery. For many, loans—regardless of their low-interest rates—may not be a viable path to address immediate needs following a disaster. Homeowners must take an active stance in understanding their insurance policies now more than ever, ensuring coverage is adequate and comprehensive. As Nyce pointed out, it’s essential to assess your homeowners’ insurance, potentially seeking additional coverage options like flood insurance, creating an emergency supply kit, and safeguarding crucial financial documents.

Preparing for a New Normal

In this rapidly changing landscape where FEMA may no longer offer the robust support it once did, the onus is squarely on individuals to prepare for inevitable disasters. Being proactive is the only way forward. Communities need to foster resilience, and citizens must educate themselves about the realities of disaster recovery, which may soon fall solely on their shoulders.

Natural disasters are becoming more frequent, and the implications of reduced federal support could lead to a devastating cascade of inadequate responses. Thus, it is imperative for citizens to not merely rely on federal aid as a fallback but to take preemptive actions to secure their homes and safeguard their futures. Whether through improving insurance coverage or developing personal emergency plans, the responsibility rests increasingly with each of us—and that’s a reality we can’t afford to ignore.

Leave a Reply